Doomed Loom! - Investors frantically trying to get back their money as the wheel stops spinning

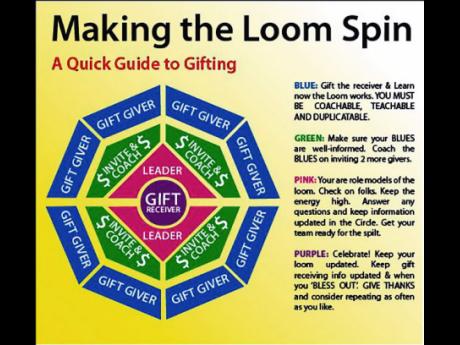

The Loom wheel that once promised Jamaicans thousands of dollars has slowed drastically, and in some cases has stopped spinning completely for a number of investors who have lost thousands of dollars.

Last week, several persons who invested in the scheme were frantically trying to get back their investments as it became clear that the dreams of big returns had transformed into nightmares.

"Is December now and all now me can't hear nothing bout me Loom, but due to how me pay me money me need fi know what a gwaan so me a go need it and me done talk," said one investor, in a WhatsApp group operated by one loom vendor.

"A two months now me a defend my money and can't get it back," said another in one of the string of posts, many too graphic for publication.

"I know of Loom stuck for four months now. if you need back the money you have to talk to the admin person and he will put up your spot for sale. if you lucky somebody buy it, that's the only way you get back your money. every day people asking back for their money and admin not answering them," said another investor.

Last month, The Sunday Gleaner reported on the increasing popularity of the scheme and how the operators had promised investors up to 300 per cent earnings on each investment.

At that time, communication and international relations manager at the Financial Services Commission (FSC), David Geddes, warned against get-rich schemes, which he pointed out were unsustainable.

FILE A FORMAL REPORT

Last week, Geddes said persons who believe they were defrauded as a result of putting money into the Loom scheme should report the matter to the police and file a formal complaint with the FSC.

"They should visit the offices of the FSC and give us as much information as they can about the persons who encouraged them to enter the scheme, and also the persons who they actually gave money to, because that is how we get to do a more thorough investigation and to find the people that are actually behind this, and get to close them down," said Geddes.

"People need to realise that there are many different paths and roads to prosperity, but Loom is not one of them. 'Blessings' and 'Christmas Gift' and those schemes are also not ways to prosperity. Invest your money in a retirement plan, for example, or try entrepreneurship, but the problem with a lot of persons today is that it has to be immediate, persons want returns immediately," added Geddes.

Since it became clear that the collapse of Loom was inevitable, persons have admitted that despite the warnings they invested in Loom with the hope that they would be among those to collect big before it collapsed.

"Me see and hear weh people did a say bout the Loom but is all about taking a chance and luck. Me couldn't resist the chance fi try me luck. Mind you, me nuh mek no money because is like me did too late to the thing but me did still afi try," said one investor.

That is part of the concern for Geddes.

"Persons know that it's a Ponzi scheme, they know that chances are they won't get back the money, but because they are being lulled into this fantasy world where there is a chance that you may get returns 10 times their money, they say 'OK, let me just try with $20,000 and try my luck'.

"But as I have always said, if you are going to try your luck it is better to try it on the stock exchange, which has outperformed many stock exchanges across the globe," said Geddes.

Tips from Geddes

- A pyramid scheme is structured so that the initial organiser must recruit other investors, who will continue to recruit other investors, and those investors will then continue to recruit additional investors, and so on.

- Sometimes there will be an incentive that is presented as an investment opportunity, such as the right to sell a particular product. Each investor pays the person who recruited them for the chance to sell this item. The recipient must share the proceeds with those at the higher levels of the pyramid structure.

- Check before you invest.

- Be wary of high-yield investment schemes which are not registered with the FSC and which are offered by unlicensed individuals.

- Look out for red flags such as secretive or complex strategies and fee structures, emphasis on recruiting and difficulty in receiving payments.

- One of the hallmarks of these schemes is the promise of high returns with little or no risk.

- Remember the adage, "if it looks too good to be true, it probably is".